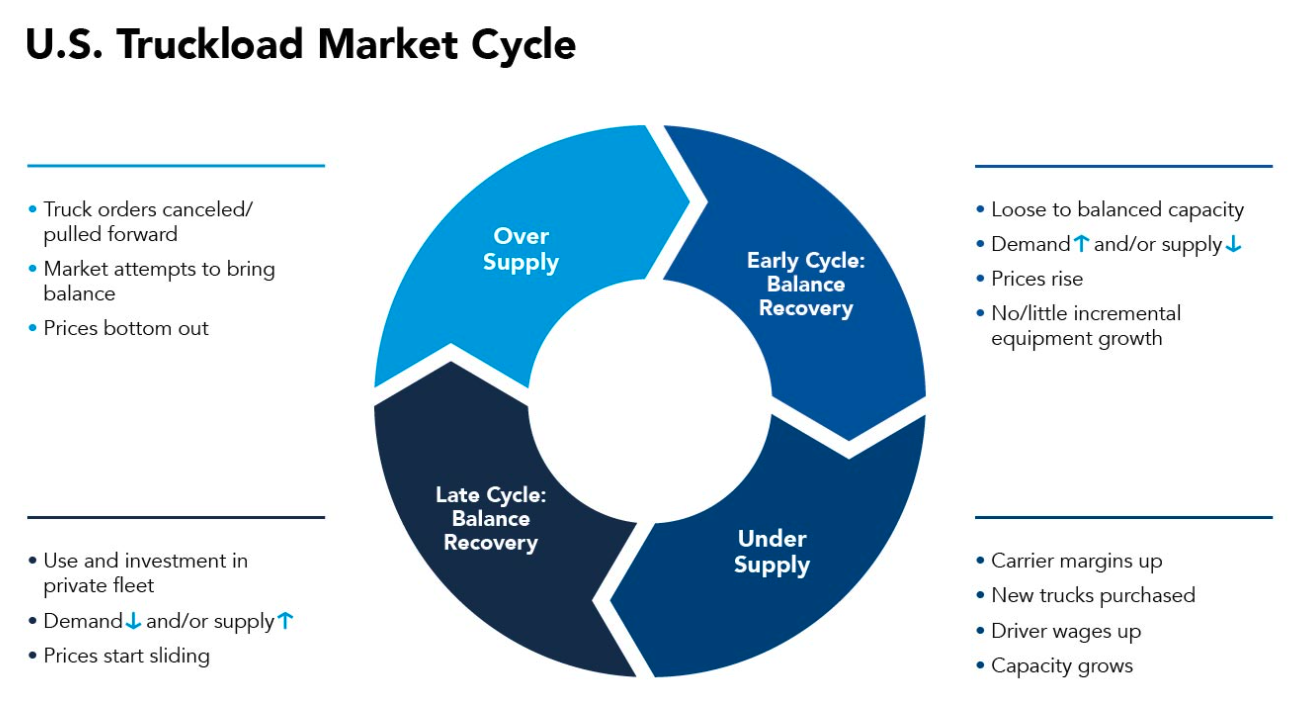

The historical truckload cycle offers valuable insights into today’s freight market dynamics and helps us anticipate future trends as we analyze the balance between demand and supply. Understanding where we are in this cycle can guide decision-making for shippers, carriers, and logistics professionals.

The U.S. truckload sector follows a recurring pattern over time. C.H. Robinson has done an excellent job of visualizing this process, using our breakdown of the truckload cycle to create a helpful graphic that illustrates the stages clearly.

Understanding the truckload cycle is essential because it provides context for interpreting current market conditions. When combined with ACT’s Class 8 tractor data, it allows for better forecasting of what lies ahead and helps stakeholders prepare for the next phase of the cycle.

**Early Cycle: Demand Recovery and Tightening Supply**

The cycle often begins in a loose or balanced market. As freight demand starts to recover, capacity tightens, leading to driver shortages. This shift in power favors carriers, who push rates higher—first in the spot market, then in contracts about six months later. During this stage, Class 8 tractor production tends to be low, while spot load-to-truck ratios and pricing begin to rise. Orders for new equipment also start to increase.

**Mid-Cycle: Capacity Expansion**

With rising rates and improved margins, fleets are incentivized to hire more drivers and invest in new trucks and trailers. This leads to increased production and long order backlogs. Due to the highly fragmented nature of the industry, many fleets make similar decisions at the same time, resulting in excess capacity being added during peak periods. This phase is marked by high tractor build rates and growing industry expansion.

**Mid-Late Cycle: Shippers Take Action**

As costs rise, shippers look for ways to reduce expenses by improving efficiency and shifting freight to private fleets. At the same time, the cycle may be nearing its peak, causing for-hire freight growth to slow or even decline. This creates a supply-demand imbalance, putting downward pressure on truckload rates and hurting carrier profitability. Order cancellations become more common as the cycle begins to turn.

**Late Cycle: Adjusting to Lower Returns**

Driver shortages may still exist, but they become less of a concern as carriers scale back their equipment investments. Equipment orders decrease, helping to bring supply and demand back into balance. This phase signals the end of the upturn, and as freight demand picks up again, the cycle starts anew.

Automatic Water Filling Machine ,Filling Machine Line,Package System Machine,Production Line Stick

Taizhou Langshun Trade Co.,ltd , https://www.longthinmachinery.com